The Mexico Energy Market Year End Report. What to expect in 2021!

2020 has posed unprecedented challenges to all of us due to COVID-19 and we hope the vaccines helps us gradually get back to normal.

2020 has also been a tough year for the Mexico energy market. The regulatory uncertainty caused by a desire to favor PEMEX and CFE has taken its toll on market participants and potential investors. As such, confidence in the Mexico energy market has been badly shaken which has translated into a severe reduction in investment within the energy sector. Renewable generation has borne the brunt of this reduction with many new renewable generation projects either cancelled or postponed as a result of the regulatory uncertainty. According to Bloomberg, around 200 generation projects are in limbo because of the Government’s policies and actions against private energy projects.

Because of regulatory uncertainty there was an increasing number of injunctions and other legal processes filed against some of the new regulations proposed by the CRE, CENACE and SENER. Many of these proposals have been aimed at reinforcing CFE’s predominant role in the market and restricting competition. Some of these regulations have been struck down in the courts while others are still pending resolution.

To compound matters, the energy situation was exacerbated by the COVID-19 pandemic, leading large end-users of energy to reduce consumption due to losses in production, sales and limited use of employees. Fortunately, many companies have taken steps to reevaluate cost reductions across their businesses and since energy is one of the top cost centers, they began looking for projects and ways to reduce energy prices and their carbon footprint. For those who used the 2020 COVID window to embrace a new way to mitigate its impact on revenue and costs will start seeing the benefits of their strategy in 2021.

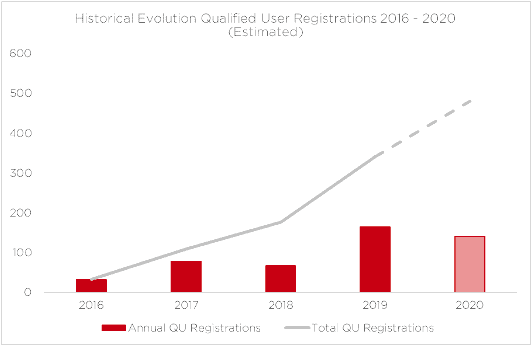

Another positive effect of the pandemic for end-users is that the electricity market became very competitive, as generators are trying to find off-takers for their energy due to depressed consumption and energy prices. A significant number of end-users have seen these market conditions as an opportunity to lower energy costs as part of their overall cost-cutting strategy and signed or negotiated supply agreements with advantageous conditions. In this context, Acclaim estimates that at least 140 new qualified users have been registered during 2020 taking the total number of qualified users to around 480. The number of qualified users would have been even greater without the delays at CRE.

In summary, 2020 is ending with a big conundrum for Mexico’s electricity market. Mexico electricity market is developing into a very competitive environment with an increasing number of end-users looking for ways to save in their energy costs, as well as considering a decentralized electricity supply model whilst the Government is taking the necessary steps to promote the opposite by limiting the options end-users have outside of CFE. So, what can it be expected in 2021 under these circumstances?

Acclaim’s point of view is that the main driver in the market will be end-users actively seeking to reduce their energy costs through:

- Switching from CFE to another supplier,

- Trying to optimize their current supply agreements, particularly in self-supply; and

- Assessing self-generation and supply reliability capabilities (e.g., rooftop solar installations or batteries)

In order to meet this demand, generators and qualified suppliers will continue to adapt and provide a very competitive environment in order to get market share by sacrificing margin. In addition, qualified suppliers will try to offer a wider array of services; for example, by developing their own self-generation business line.

On the negative side, the regulatory uncertainty will continue. The current Administration will pursue the strengthening of CFE and PEMEX. This effort will be spurred if MORENA wins the majority in the mid-term election, as this majority will be seen as a validation of the current energy policy. Regardless of whether MORENA wins the majority or not, it is anticipated that market participants will continue to push back on the Government’s actions to curtail the energy market and will seek relief through the Courts.

The other piece of regulatory uncertainty will be the attitude of Biden’s administration towards AMLO’s stance on energy. Market participants are hopeful that the US Government will play a more active role of pushing back on Mexico’s narrowing vision on the energy market and enforce the energy language of NAFTA 2.0 as a backstop against the Governments energy policies.

It is evident that a very limited number of new private generation projects will come online during 2021 due to the Government’s actions. This lack of new generation, combined with the reduction in available merchant capacity as more PPAs are signed; and the gradual increase in demand may lead to a significant increase in capacity prices in the market. This increase in capacity prices will in turn, translate in more expensive energy prices as a whole outside of CFE Basic Supply. This means that end-users will pay a premium to ensure that they have access to electricity when they need it. It will be interesting to see the settlement price in the upcoming Capacity Balancing Market to see if the upward trend in capacity prices continues. The 2020 Capacity Balancing Market price doubled 2019 price.

Another area to focus on will be the carbon credits market. SENER is yet to publish the CELs requirements beyond 2022 and it is becoming more apparent that SENER is not willing to publish these new requirements to avoid impacting CFE’s financial position and to reduce the financial viability of renewable projects. So, the big question is whether SEMARNAT’s proposed carbon market will get some traction or not during 2021 and if the carbon credits allocation will be fair. The allocation of carbon credits is crucial, because it can favor one player or sector, skewing the supply and demand in the market and could create artificial arbitrage and market cornering opportunities from the inception.

2021 will be a very interesting and crucial year for the Mexico energy market due to the ongoing regulatory uncertainty whilst end-users actively seek savings and access to renewable generation. Despite the eb and flow of the market, there are always measures companies can take to optimize their energy profile.

Acclaim Energy will be there supporting all market participants as their trusted partner to strategically manage their energy and meet their financial and ESG goals.

The Acclaim Team wishes you well and hopes you enjoy good fortune and good health in 2021!