The Current Challenges of Large Consumers of Natural Gas

Natural gas has increased its availability in much of the national territory in recent years. There are regions of Mexico that now have access to improve their competitiveness by using a cleaner fuel that is expected to remain cheaper than liquid hydrocarbons for decades. Some of these regions, such as in the northwest of the country and its Pacific coast, never had that opportunity before and now can start using this fuel as a result of pipelines such as the Sásabe-Puerto- Libertad-Mazatlán, that have become available. Other regions in the west, center and south now have greater transportation capacity as other pipelines come into operation, such as the Sur de Texas-Tuxpan submarine pipeline that is ramping up and recently reached the 1 BCFD threshold, which makes it feasible for them to access the use of natural gas under more reliable conditions.

The increase in transportation capacity within the country allows a greater number of consumers of natural gas access to the transportation of this fuel in firm-based capacity contracts that give them more reliability. The rules in laws and regulations are in force for open and not-unduly discriminatory access for all users, that means fair treatment to all regardless of size. State institutions with clear mandates to regulate and make this a reality have an opportunity to put it into full operation in the short term, as new pipelines, interconnections and compression capacity begin operations. The greater reliability of transportation and the stabilization of national gas production allow us to foresee that the national objective of having a full supply of this fuel will be gradually fulfilled, which is essential to reduce costs in industry, because of its low prices.

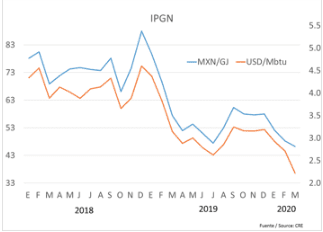

Current natural gas prices are very attractive in Mexico due to the drop in demand for all hydrocarbons during the current COVID-19 health crisis. According to the wholesale national price index pub

lished by the Energy Regulatory Commission (IPGN), last March natural gas prices were 23.4 percent lower than six months ago, in September 2019. The drop was even greater in dollar terms (31.7 percent), but the movement of the exchange rate partially offset it. Prices in the US recently fell due to a reduction in demand expected to be temporary, but anticipated to pick up moderately once the health crisis is over. In the long term, natural gas prices will probably remain very competitive in a range of between $3 and $3.5 per million Btu.

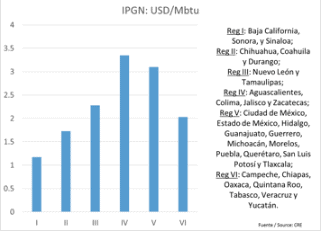

There is a great price-dispersion within Mexico, which reflect the bottlenecks that transportation faces. In March 2020, prices in the northwestern states of Mexico had average prices that were less than half of those observed in the western states of the country. These price differentials will fall considerably with the entry into operation of pipelines that will allow gas from western Texas, one of the cheapest in the world due to the lack of capacity to move it to consumption centers, from the north south through Chihuahua to Laguna and from there to Aguascalientes and Guadalajara. The price differentials between Western and South Texas will reflect infrastructure developments in the US that are under construction and, in particular, by the global demand for LNG produced in their new gas liquefaction terminals in the Gulf of Mexico.

In this context, the large consumers of natural gas in Mexico face great challenges. They have to understand the structural changes that affect the availability of this fuel in their region and the

process of price convergence in Mexico with those within the United States. Furthermore, these large natural gas consumers must process that there is an increase in commercial opportunities due to the entry of new marketers to the industry and what this means in opportunities of better prices and contractual conditions. The price and service conditions that consumers will be able to achieve will depend on the size of their natural gas consumption.

A clearer understanding of what is happening with gas in North America, as well as what will happen and the speed with which changes can be expected will allow companies in Mexico to choose their potential natural gas marketers, define the commercial scheme that they require, and obtain the best price and service conditions. To make the changes in gas procurement that companies require, it is important that they have a strategic approach, similar to that used for the rest of their project planning. They must be clear about where they are today, the environment they currently face and how it will change, as well as what they want to achieve and in what period they can do it. This will allow them to define a roadmap with precise actions, which forms a strategic plan to achieve the safe, reliable, and efficient supply of natural gas that supports growth through greater competitiveness.

If you need to understand current and future trends of the natural gas market, design a strategic plan for your expenditure in fuels, or execute a competitive procurement for natural gas contact Acclaim. We are energy consultants focused on the large energy consumers with a strategic approach to reduce the energy costs, and improve competitiveness.