One of the main objectives of the 2014 Energy Reform was to break up the monopolistic positions of CFE and PEMEX to allow all market participants to play on a level field. It is very well documented that Lopez Obrador’s Administration has speculated about returning to a scenario whereby CFE and PEMEX would have the position of dominance in the energy market.

What would be the impact on Mexico’s energy market should there be a return to the market conditions prior to the energy reform?

The end user, particularly in the C&I spectrum, would be impacted dramatically, since they would no longer be able to enjoy the current levels of competitiveness when it comes to savings and transparency regarding supplier bids and contract terms. A return to the old scenario, in which electricity tariffs are set arbitrarily with little or no economic rationale, would inevitably lead to C&I users paying higher tariffs. This increase in tariffs could somehow be disguised as an attempt to finance the modernization of the distribution and transmission network and new generation projects. However, any increase in tariffs would most likely be used to subsidize residential tariffs, the maintenance of old and inefficient plants, which run on more expensive fuel oil and diesel; and could be used to cover CFE’s pension, financial liabilities and shortfall in revenues.

Any lack of transparency and competitiveness could also affect generators and energy developers. Mrs. Rocio Nahle, Secretary of Energy, has highlighted on several occasions that Mexico needs and requires private investment in the energy sector to meet the demand and transition into a new energy model, where renewable and clean energy plays a strong role and end users can benefit from clean and cheaper energy. However, facilitating and empowering an asymmetric regulatory framework with weak or non-existent independent regulatory bodies and where rules and regulations appear to favor CFE and/or PEMEX, would likely deter additional investments required to help Mexico’s energy transition.

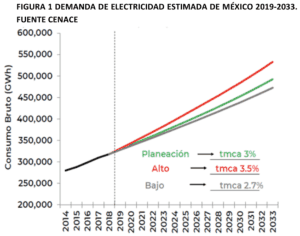

Any lack of investment will exacerbate the current problems of blackouts, constraints in gas supply and other inefficiencies in Mexico’s energy infrastructure and market at a time where Mexico’s electricity demand is expected to increase an estimated 3% on average on an annual basis in the coming years.

An unintended consequence of CFE’s inability to guarantee electricity supply and the uncertainty around the amount of investment required in energy infrastructure would be a widening of the current energy poverty levels. The widening in energy poverty levels means less access to cheap and clean energy and would also have a significant social impact when it comes to sustainability.

In conclusion, any decision about returning to an old and centralized energy model orbiting around CFE

and PEMEX will have a profound socio-economic impact, which everyone should understand. As a country, Mexico is at a critical period when it comes to building an energy model that best supports the country in the long-term and helps achieve environmental targets. The President and his Administration have many challenges when trying to fulfill their campaign promises, but we are hopeful they continue to build on the energy reforms created several years back. Given the success of energy deregulated markets in other countries and the progress made by Mexico so far, the current Administration should have confidence that there are better days ahead if they move further away from a monopolistic approach to energy management. By embracing, an energy model where renewable and clean energy is maximized and keeps bringing in significant levels of investment and competitiveness, will create a greater future for economic growth and a more sustainable environment for our future.